Dax 30 trading strategy

Many experienced traders work to reduce the amount of time spent in front of a screen. However, very few are able to reduce the time spent on trading to five minutes a day — but it is possible. Using intraday data, we searched for market quirks for traders to exploit.

We followed the system mechanically every trading day back in August The trades and results were tracked each day on the CMC Markets Blog.

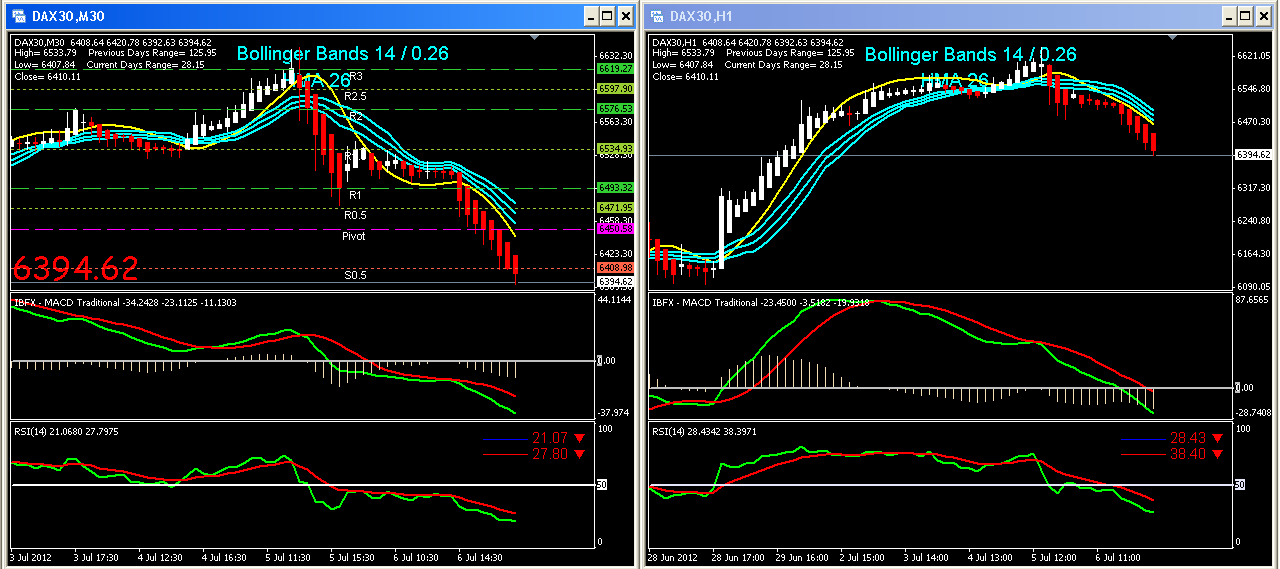

Click here for the summary and results for the month. Now, Leo the quant has helped identify another 5MADT candidate — the Germany 30 Index, tracking the DAX. It appears from the analysis that the early direction in German share market trading is reliable, and we have a 5MADT strategy to exploit this characteristic.

Experienced traders know that long term profitability is a function of two key ratios — the percentage of trades that are successful, and the realised profit to loss ratio. We analysed the data to discover a winning combination, based on the level of the Germany 30 Index after the physical market opening. The analysis is based on the physical market, after the opening rotation, and the reference time is 9. These are the current times — the analysis was adjusted for daylight savings time.

To be clear, the reference level is the opening of the one minute bar at 7.

The analysis shows that the combination of a 3. Both orders have an attached stop loss 11 pips away, and a take profit order 35 pips away. Care should be taken in examining the table below — past performance is not necessarily a guide to future returns.

As the table shows, this strategy was profitable in eight of the last ten months. A trader taking 5 minutes a day to apply this strategy over the last ten months could be up pips.

In a month of 22 trading days, just six profitable trades will deliver a profit for the month. Months such as May, where 11 of 22 trades are profitable, the gain is significant.

Similarly, months like November, where only two trades made profit, result in a loss for the month. Note — over the course of the study, on four occasions the trade was not closed within the study period up to 6 am Sydney time the following day. These days were stripped for analysis purposes. Stop loss at 7, The trader also creates price alerts at the two entry levels 7, The trader receives an alert, and cancels the SELL order order 2. As there are attached stop loss and take profit levels attached to order 1, there is no further action required.

This is a single day example, and the stop loss target will most likely be hit on more trading days than the take profit.

The reason the trader expects to make profit from the strategy is the 35 pips won on successful trades exceeds the 11 pips lost on unsuccessful trades.

Slippage is another risk. Slippage commonly occurs in fast, illiquid markets. The Germany 30 is a highly liquid, globally traded index. This should limit slippage impacts. This function can also be used for stop loss and take profit orders.

Gap risk is also a possibility. On the occasions where a trade is not closed before the end of the trading session at 8 am the following day occurring on 4 days out of in the study the trade is exposed to any gap in levels between the closing price of the Germany 30 index and the open price of the next session.

Traders may wish to take a minute to check their positions in the last half hour of the session 7. Perhaps a greater risk to the strategy is failing to place the trade. Missing just one profitable trade can have a significant impact on the result. Traders successfully using this method must make every effort to trade all of the days in the month.

Similarly, the study assumes that each trade is the same size — varying the size of trades could also materially alter the results. Look out for regular updates on the blog. This website uses cookies to improve your experience and access our trading platform.

You can manage cookies in your browser settings or continue to use the site as normal. Investing in CMC Markets derivative products carries significant risks and is not suitable for all investors. You could lose more than your deposits. You do not own, or have any interest in, the underlying assets. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading.

Spreads may widen dependent on liquidity and market volatility.

Andrea Unger shares his DAX Strategy & Winning Ways with Automated Trading - 52 Traders Podcast

The information on this website is prepared without considering your objectives, financial situation or needs. Consequently, you should consider the information in light of your objectives, financial situation and needs. CMC Markets Asia Pacific Pty Ltd ABN 11 , AFSL No. It's important for you to consider the relevant Product Disclosure Statement 'PDS' and any other relevant CMC Markets Documents before you decide whether or not to acquire any of the financial products.

Our Financial Services Guide contains details of our fees and charges. All of these documents are available at cmcmarkets. Apple, iPad, and iPhone are trademarks of Apple Inc. App Store is a service mark of Apple Inc. Android is a trademark of Google Inc. Products Ways you can trade CFDs Stockbroking Binaries Countdowns CFD vs Share trading What you can trade Forex Indices Shares Commodities Treasuries Stockbroking investment products Stockbroking Frequent Trader Program Brokerage rates Funding Investment products Sell shares only service IPOs and placements Stockbroking Account types CFDs Spreads Margins Rebates Premium services Other costs CFD Account types Binaries Binary trade types.

Options trading What is an mFund? Learn forex trading What is forex?

Striker - Striker Securities - Futures Trade Systems, Commodity Trading, Alternative Investments

Benefits of trading forex? Forex leverage Forex trading examples Learn CFD trading What are CFDs? Benefits of trading CFDs CFD trading examples What is a spread? Help topics Getting started Account applications Charges Funding and withdrawals Products Glossary Top FAQs CFD Do you offer a demo account? Is there any support on the platform? How do I fund my account?

3 Tricks for Trading the DAX - BDSwissBDSwiss

How can I reset my password? Where can I find my account number? Top FAQs Stockbroking How do I start trading with CMC Markets Stockbroking? How do I do a one-off sale? How do I pay for my shares? What is your brokerage? Can I trade my margin loan with you? Contact us Premium Services. Create a CFD account Trade CFDs on over 10, shares, FX pairs, commodities, indices and treasuries Professional charting, powerful tools and innovative platform navigation Open a live CFD account Losses can exceed your deposits.

Five Minutes a Day Trading - Germany If you'd prefer to watch than read, here's a summary of the 5MADT strategy: The Method The analysis shows that the combination of a 3. Market Analysis Results Care should be taken in examining the table below — past performance is not necessarily a guide to future returns.

The Example At 7. BUY Germany 30 at 7, SELL Germany 30 at 7, Risks and Rewards The average loss in unprofitable months in the study: Maximum possible loss 0 profitable trades out of Open a stockbroking account Access our full range of stockbroking products, share trading tools and features. Open a CFD trading account Access our full range of products, CFD trading tools and features. Back to top Personal Partners Group. Products What you can trade Forex Indices Shares Commodities Treasuries Stockbroking CFDs CFD Account types Binaries.

Learn Learn binary trading Learn share trading Learn forex trading Learn CFD trading. Support Help topics Getting started Account applications Charges. Call us Legal documents Important information Privacy Cookies Public relations Careers Contact us.