Explain stock brokerage fees canadian

We respect your email privacy. The promise of commission-free ETFs has steered many index investors toward independent brokerages such as Questrade and Virtual Brokers. These deep discounters have a lot to offer, but before you sign on, make sure you understand the details of their pricing.

Orders at these brokerages may be subject to fees that originate with the exchanges and networks that match buyers and sellers. This includes the big boys such as the Toronto and New York Stock Exchanges, as well as a host of lesser-known electronic communication networks ECNs and alternative trading systems ATSs.

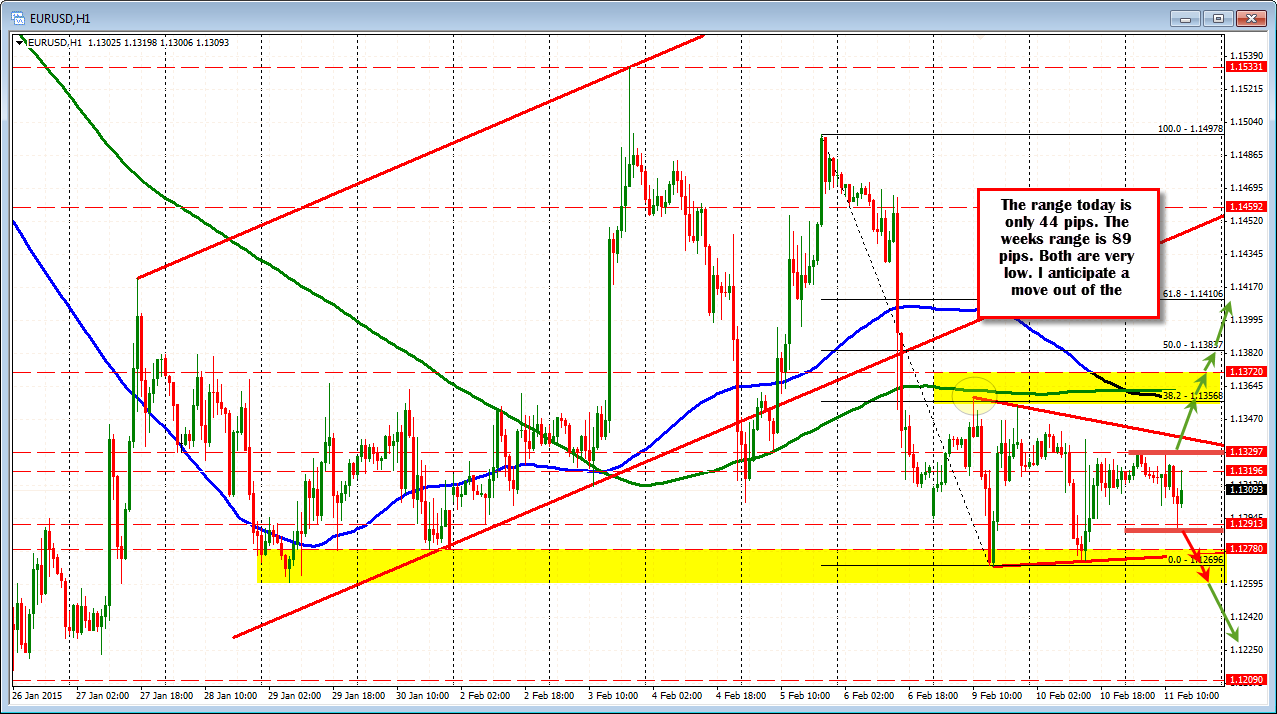

ECN fees are applied on a per-share basis. ECN fees do not apply on every trade: An order that removes liquidity is one that is likely to be filled immediately. That includes all market orders , where the investor simply accepts the current price without specifying a minimum or maximum. It also includes marketable limit orders, which I described in my previous post. A marketable limit order specifies a price that is either above the ask when buying or below the bid when selling.

Like a market order, this type of limit order will usually be filled right away. Now consider a limit order with a price that is lower than the ask when buying or higher than the bid when selling: In most cases, whenever a trade is filled, one party adds liquidity and the other removes it. Only the latter will be charged ECN fees.

Suppose three investors—Mark, Cheryl and Barney—want to buy shares of the Vanguard Canadian Aggregate Bond VAB. Their quote looks like this:. In this example, both Mark and Cheryl are likely to see their orders filled immediately, so they are removing liquidity. There is another way you can incur ECN fees, even if you use a nonmarketable limit order: In trader jargon, blocks of shares are called board lots , while blocks of fewer than shares are called odd lots.

Moreover, a mixed lot may get broken into two separate orders, with the board lots and odd lot filled separately. If this happens, ECN fees may apply to the odd lot, though not the entire order. This is a popular question on web forums, and the answer usually goes like this: More important, using nonmarketable limit orders is poor practice that can easily lead to throwing away dollars to save pennies.

But look what happened: The lesson here should be clear: Use marketable limit orders for all your trades, even if it costs you a couple of bucks. It makes no sense to risk seeing your order go unfilled to save a fraction of a penny per share.

Just to be clear: These are actually the two which are probably of interest to casual traders. On the other hand, Interactive Brokers, which may not be suitable for most DIY investors, will actually pass on rebates for adding liquidity and also pass on the fees for removing liquidity.

Other brokerages keep the rebates for themselves. Thanks for the info. Clearly the policies are different at every brokerage, so if other readers have experiences to share, please do so.

It was surprisingly hard to find clear and reliable info on this topic. ECN fees are brought up in online forums way too often. Unless you trade penny stocks, its not worth the time spent worrying about it. I tend to agree.

Canada's best and worst online brokers in - The Globe and Mail

It reminds me of people who drive out of their way to save a penny per litre on gas. I never knew this, thanx, really enjoyed this article.

Pricing - Commissions and Fees - RBC Direct Investing

I am in the lowest tax bracket. Dan — your last couple of ETF articles have been super. I always thought buying non-board lots was a bad idea. My online broker TD Waterhouse posts a warning when you do this.

It might be more of an issue with less liquid ETFs. At that point the question becomes, how concerned are you about paying an extra penny for less than shares? Dan, I use Interactive Brokers and have never been charged an ECN fee or a fee for odd lots. And IB is now a Canadian online broker. Although I can appreciate that your hypothetical buyer buys at a higher price the following day in a rising market, the reverse situation is also true: The mathematical expectation is essentially zero for setting your limit order one cent below the ask price if we assume that the price of the stock moves randomly.

Most of the ETFs I purchase tend to have their bid or ask price fluctuate by at least 1 cent several times a minute, in both up and down directions.

Very rarely do I end up paying higher than I would have if I had just placed a market order. The fact is there are very few investors like this. Most people trade too much, plain and simple. This is commission and ECN fee free to purchase. You state most people trade too much, plain and simple. Does that statement apply only when using discount brokers that charge purchase commissions and ECN fees? I stumbled on this subject when trying to buy 1.

Difficult to understand the rationale. I opened an account with Questrade due to the low advertised commission. Placed a couple of market order stock trades and being charged for ecn fees.

However, a recent experience with DLR made we wonder if your advice to just accept ECN fees still holds true at larger volumes. TO, journalled it over to DLR. TO and sold it. In this case, there was no way around the ECN fees; DLR.

We generally assume you lose another 0. Thanks for the reply Dan. I appreciate your always level-headed responses to such issues. Email will not be published required. Contact Disclaimer and Policies. Navigation Canadian Couch Potato Your complete guide to index investing. Email Marketing by AWeber. Understanding ECN Fees December 18, Subscribe to our e-mail newsletter to receive updates. The Limits of Limit Orders. The Folly of Forecasts. Tyler December 18, at Russ December 18, at 1: Canadian Couch Potato December 18, at 1: Matt December 18, at 2: Canadian Couch Potato December 18, at 3: Ashley December 18, at 3: Chris December 19, at David McKenna December 19, at Gwynne December 19, at ECN fees are very confusing.

This has shed a lot of light on the topic.

Canadian Couch Potato December 19, at RDR December 19, at 4: SNB December 19, at 9: Dan, Although I can appreciate that your hypothetical buyer buys at a higher price the following day in a rising market, the reverse situation is also true: Elbyron December 23, at 1: Rod-knee January 5, at 5: Canadian Couch Potato January 6, at 2: Kevin Kane February 9, at 7: Dan, thanks for explaining the ECN fees.

The ECN fees were only 19 cents.

20 HIGHEST PAYING DIVIDEND STOCKS // CANADA BASEDI work for a Canadian bank. We have a highly-rated, self-directed trading platform. But even with my employee discount, Questrade still offers lower trading costs on ETFs. Nic M July 6, at 9: Canadian Couch Potato July 6, at 9: Nic M July 7, at 7: Harry February 2, at 8: What happens when you buy 1 share, which its ECN fee is less than 1 cent, does it get charged?

Jay April 6, at 7: Freeman July 11, at 1: Peter December 3, at 5: I googled ECN fees and your name came up.

A trusted source on all investor topics. Chrissy April 25, at 4: That said, what are your thoughts?

Is this just an unavoidable cost? Canadian Couch Potato April 25, at 7: Chrissy April 26, at 1: Leave a Reply Click here to cancel reply. Comment Name required Email will not be published required Website. Categories Ask the Spud 29 Asset classes 58 Behavioral finance 49 Bonds 56 Book reviews 46 Commodities 9 Discount brokers 44 Dividends 34 ETFs Financial planning 21 Foreign currency 38 Index funds 49 Indexes 56 Indexing basics 97 New products 87 Podcast 12 Research 77 Smart beta 16 Taxes 67 Uncategorized 5 Under the Hood Contact Disclaimer and Policies site by.