Foreign currency conversion as per as11

Based on the consultations with ICAI and FEDAI and also taking into account the difficulties expressed by banks in complying with the Standard, the issues that arise and require clarification have been identified and the guidelines on compliance with AS 11 revised are furnished in the Annex. Banks are advised to place these Guidelines before the Board of Directors and ensure strict compliance with the Standard.

These guidelines are in supersession of the instructions contained in our circular DBOD No. Banks may be guided by the following while complying with the Standard. Banks are advised to place these guidelines before the Board of Directors and ensure strict compliance with the Standard. For this purpose, foreign operations are classified as either 'integral foreign operations' or 'non-integral foreign operations'.

While complying with the Standard, a doubt may arise on the classification of representative offices set up in foreign countries, foreign branches and off-shore banking units set up in India as "integral foreign operation" or "non-integral foreign operation". Paragraphs 18 and 19 of the Standard explain "integral foreign operation" and "non-integral foreign operation".

Paragraph 20 of the Standard provides indications as to when a foreign operation is a non-integral foreign operation rather than an integral foreign operation.

Taking into consideration the operation of the foreign branches of Indian banks and the indicators listed in paragraph 20, foreign branches of Indian banks would be classified as "non-integral foreign operations".

Similarly, Offshore Banking Units OBUs set up in India by banks would also be classified as "non-integral foreign operations".

Taking into consideration the operation of the representative offices of banks set up abroad and the explanation in paragraph 18 of the Standard, Representative Offices would be classified as "integral foreign operations". These classifications are for the limited purpose of compliance with the Standard. Exchange rate for recording foreign currency transactions and translation of financial statements of non-integral foreign operation.

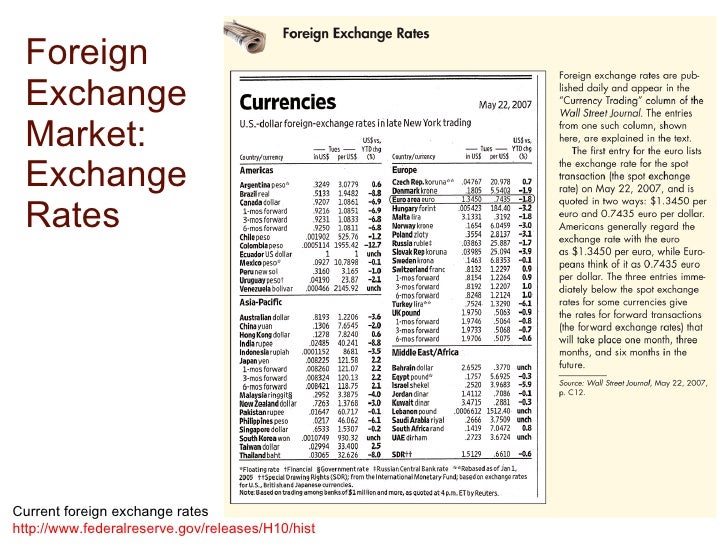

As per paragraphs 9 and 21 of the Standard, a foreign currency transaction should be recorded by Indian branches and integral foreign operations, on initial recognition in the reporting currency, by applying to the foreign currency amount the exchange rate between the reporting currency and the foreign currency at the date of the transaction.

Further, paragraph 24 b of the Standard states that income and expense items of non-integral foreign operations should be translated at exchange rates at the dates of the transactions. While adopting the Standard, Indian branches and integral foreign operations of banks may face difficulty in applying the exchange rate prevailing at the date of the transaction in respect of the items which are not being recorded in Indian Rupees or are currently being recorded using a notional exchange rate, due to their extensive branch network and volume of transactions.

Similarly, banks may face difficulty in translating income and expense items of a non-integral foreign operation by applying the exchange rates at the dates of the transactions. Banks, which are in a position to apply the exchange rate prevailing on the date of the transaction for recording the foreign currency transactions at their Indian branches and integral foreign operations and for translating the income and expense items of non-integral foreign operations as required under AS 11 are encouraged to comply with the requirements.

Banks, which have an extensive branch network, which have a high volume of foreign currency transactions and are not fully equipped on the technology front may be guided by the following:. Paragraph 10 of the Standard allows, for practical reasons, the use of a rate that approximates the actual rate at the date of the transaction.

For example, an average rate for a week or a month might be used for all transactions in each foreign currency occurring during that period. Similarly, in respect of the non-integral foreign operations, paragraph 25 of the Standard provides that for practical reasons, a rate that approximates the actual exchange rates, for example an average rate for the period, is often used to translate income and expense items of a foreign operation.

The Standard also states that if exchange rates fluctuate significantly, the use of average rate for a period is unreliable. Therefore, as per the Standard, except in cases where exchange rates fluctuate significantly, a rate that approximates the actual rate at the date of the transaction may be used. Since the enterprises are required to record the transactions at the date of the occurrence thereof, the weekly average closing rate of the preceding week can be used for recording the transactions occurring in the relevant week, if the same approximates the actual rate at the date of the transaction.

Accounting standard (AS - 11)

In view of the practical difficulties which banks may have in applying the exchange rates at the dates of the transactions and since the Standard allows the use of a rate that approximates the actual rate at the date of the transaction, banks may use average rates as detailed below: FEDAI has agreed to publish a weekly average closing rate at the end of each week and a quarterly average closing rate at the end of each quarter for various currencies.

In respect of Indian branches and integral foreign operations, those foreign currency transactions, which are currently not being recorded in Indian Rupees at the date of the transaction or are being recorded using a notional exchange rate may now be recorded at the date of the transaction by using the weekly average closing rate of the preceding week, published by FEDAI, if the same approximates the actual rate at the date of the transaction.

Generally, Indian banks prepare the consolidated accounts for their domestic and foreign branches at quarterly or longer intervals.

AS : Currency conversion gain / loss

Hence, banks may use the quarterly average closing rate, published by FEDAI at the end of each quarter, for translating the income and expense items of non-integral foreign operations during the quarter. If the weekly average closing rate of the preceding week does not approximate the actual rate at the date of the transaction, the closing rate at the date of the transaction should be used.

For this purpose, the weekly average closing rate of the preceding week would not be considered approximating the actual rate at the date of the transaction if the difference between a the weekly average closing rate of the preceding week and b the exchange rate prevailing at the date of the transaction, is more than five percent of b.

In respect of non-integral foreign operations, if there are significant exchange fluctuations during the quarter, the income and expense items of non-integral foreign operations should be translated by using the exchange rate at the date of the transaction instead of the quarterly average closing rate. For this purpose, the exchange rate fluctuation would be considered as significant, if the difference between the two rates is more than ten percent of the exchange rate prevailing at the date of the transaction.

Banks are, however, encouraged to equip themselves to record the foreign currency transactions of Indian branches as well as integral foreign operations and translate the income as well as expense items of non-integral foreign operations at the exchange rate prevailing on the date of the transaction.

In order to ensure uniformity among banks, closing rate to be applied for the purposes of AS 11 revised for the relevant accounting period would be the last closing spot rate of exchange announced by FEDAI for that accounting period.

RBI considers that with the issue of the guidelines as above and adoption of the prescribed procedures, there should normally be no need for any Statutory Auditor for qualifying financial statements of a bank for non-compliance with Accounting Standard 11 revised Hence, it is essential that both the banks and the Statutory Central Auditors adopt the guidelines and the procedures prescribed.

Whenever specific difference in opinion arises among the auditors, the Statutory Central Auditors would take a final view. Persisting difference, if any, could be sorted out in prior consultation with RBI, if necessary. Skip to main content.

AS Effects of Changes in Exchange Rates | Chartered Club: Q&A Forum for CA & Taxpayers

Search the Website Search. Home About Us Notifications Press Releases Speeches Publications Annual Half-Yearly Quarterly Bi-monthly Monthly Weekly Occasional Reports Lectures Statistics Data Releases Database on Indian Economy. Classification of Integral and Non-integral Foreign Operations. Action to be taken by banks 3. Action to be taken by banks 4.

Banks, which have an extensive branch network, which have a high volume of foreign currency transactions and are not fully equipped on the technology front may be guided by the following: Action to be taken by banks 5.

All Months January February March April May June July August September October November December. Events Public Speaking Engagements RBI Clarifications Right to Information Act Related Links. RBI's Core Purpose, Values and Vision Citizens' Charter Timelines for Regulatory Approvals Complaints Contact Us. Follow RBI RSS Twitter Videos. The two most important features of the site are: One, in addition to the default site, the refurbished site also has all the information bifurcated functionwise; two, a much improved search — well, at least we think so but you be the judge.

With this makeover, we also take a small step into social media.

We will now use Twitter albeit one way to send out alerts on the announcements we make and YouTube to place in public domain our press conferences, interviews of our top management, events, such as, town halls and of course, some films aimed at consumer literacy.

The site can be accessed through most browsers and devices; it also meets accessibility standards. Please save the url of the refurbished site in your favourites as we will give up the existing site shortly and register or re-register yourselves for receiving RSS feeds for uninterrupted alerts from the Reserve Bank.

Do feel free to give us your feedback by clicking on the feedback button on the right hand corner of the refurbished site.