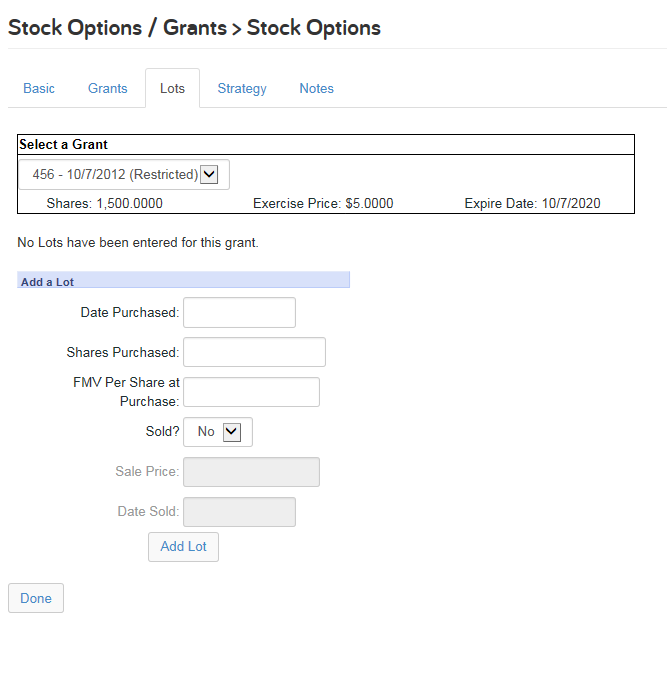

Taxability of restricted stock options

Tax errors can be costly! Don't draw unwanted attention from the IRS. Our Tax Center explains and illustrates the tax rules for sales of company stock, W-2s, withholding, estimated taxes, AMT, and more. The timing of taxation is different than that of stock options.

You pay tax at the time the restrictions on the stock lapse. This occurs when you have satisfied the vesting requirements and are certain to receive the stock i. Your taxable income is the market value of the stock at that time, minus any amount paid for the stock. You have compensation income subject to federal and employment tax Social Security and Medicare and any state and local tax.

It is then subject to mandatory supplemental wage withholding.

How Do Stock Options and RSUs Differ?

See a related FAQ for details on tax withholding and the ways of paying it. If you have restricted stock units, the taxation is similar, except you cannot make an 83 b election discussed below to be taxed at grant.

With RSUs you are taxed when the shares are delivered to you, which is almost always at vesting some plans offer deferral of share delivery. For details, see the section on RSUs.

You do not pay for the grant. Each vesting increment of this total is taxable, and withholding applies on each vesting date.

Improving Tax Results for Your Stock Option or Restricted Stock Grant

For annotated diagrams showing how to report this sale on your tax return, see Reporting Company Stock Sales in the Tax Center. Alternatively, you can make a Section 83 b election with the IRS within 30 days of the grant this choice is unavailable for restricted stock units.

Restricted stock options tax reportingThis means you pay taxes on the value of the stock at grant, starting your capital-gains holding period for later resales. If the shares never vest because you leave the company, you cannot recover the taxes you paid at grant. For details of the risks associated with the 83 b election, see the relevant article. You can also receive dividends with restricted stock.

How Restricted Stock And RSUs Are Taxed

Dividends are taxable the tax treatment is discussed in another FAQ. Need a financial, tax, or legal advisor? Search AdvisorFind from myStockOptions. Taxes When and how is a grant of restricted stock or RSUs taxed? Stock price at grant: Stock price at year one: Stock price at year two: Stock price at year three: Stock price at year four: Year from grant date Stock price at vesting Ordinary income Tax timing and withholding One: Two years after the last shares vest, you sell all of the stock.

With the facts of the previous example: You make a timely 83 b election at grant. Home My Records My Tools My Library.

Tax Center Global Tax Guide Discussion Forum Glossary. About Us Corporate Customization Licensing Sponsorships.

Newsletter User Agreement Privacy Sitemap. The content is provided as an educational resource.

How Restricted Stock And RSUs Are Taxed

Please do not copy or excerpt this information without the express permission of myStockOptions. Year from grant date. Next FAQ in list.