Put option bid price

For those more experienced options traders, I'm wondering if you can share what you've found in regard to purchasing near, at or possibly below the bid.

For example, yesterday in a slightly rising market for a stock, I placed a limit order to buy a call at the bid price, and it was executed after about 5 minutes, even as the stock was rising in price slightly, but steadily. My specific questions are:. Are there things particular to market conditions that allow this? Obviously in a falling market, the bid price is also falling.. I'm imagining all experienced options traders run in this either directly or indirectly, as limit orders are hit?

Your experience is much appreciated. So this graph is from this morning, look at the option prices, volume, stock price, and volume.

I understand the question, I think. The tough thing is that trades over the next brief time are random, or appear so. When I want to trade options, I make sure the strike has decent volume, and enter a market order. Edit - I reworded a bit to clarify. The Black—Scholes is a model, not a rigid equation.

Say I discover an option that's underpriced, but it trades under right until it expires. It's not like there's a reversion to the mean that will occur. There are some very sophisticated traders who use these tools to trade in some very high volumes, for them, it may produce results. When I say illiquid, I mean almost non-existent: For illiquid single stock options, you need to be extremely mindful of implied and statistical volatility.

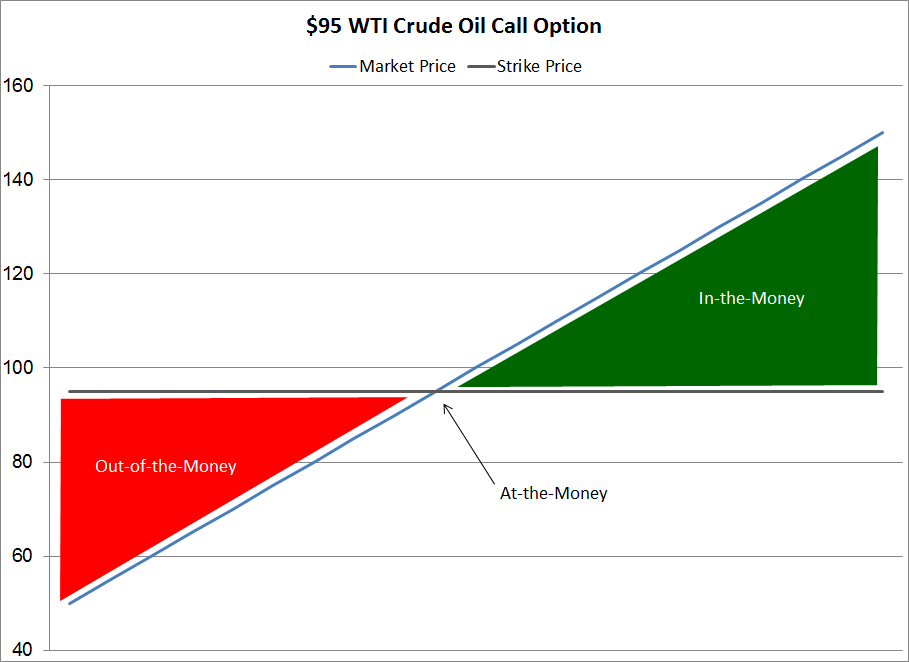

Bid and Ask Price for Options

You can't just try to always put your order in the middle. The MMs will play with the middle to get you to buy at higher IVs and sell at lower. I've never seen this happen. The only other way is like you said: People must simply be willing to match your orders if they know about it. You can sniff orders out if you can see them or predict them.

For instance, you can look at an order book and decide who you want to get filled at, especially if you are looking at different quotes from different exchanges. You or a program can just watch the level 2's and place an order as soon as you see one you like.

The orders on the level2's do not reveal ALL interested market participants. I frequently do this on NADEX, selling out-of-the-money binary calls. If I place an above-ask order, it either gets filled quickly within a few minutes due to a spike in the underlying, or not at all.

I compensate by changing my price hourly.

As Joe notes, one of Black-Scholes inputs is volatility, but price determines implied volatility, so this is circular. This isn't as far-fetched as it seems: This sometimes happens to me.

It depends on how liquid the option is. Normally what I see happening is that the order book mutates itself around my order. I interpret this to mean that the order book is primarily market makers. They see a retail investor me come in and, since they don't have any interest in this illiquid option, they back off.

Some other retail investor or whatever steps in with a market order, and we get matched up. I get a fill because I become the market maker for a brief while. On highly liquid options, buy limits at the bid tend to get swallowed because the market makers are working the spread. With very small orders a contract or two on very liquid options, I've had luck getting quick fills in the middle of the spread, which I attribute to MM's rebalancing their holdings on the cheap, although sometimes I like to think there's some other anal-retentive like me out there that hates to see such a lopsided book.

I haven't noticed any particular tendency for this to happen more with puts or calls, or with buy vs sell transactions. By posting your answer, you agree to the privacy policy and terms of service.

By subscribing, you agree to the privacy policy and terms of service. Sign up or log in to customize your list. Stack Exchange Inbox Reputation and Badges. Questions Tags Users Badges Unanswered.

Put Options by gedyfej.web.fc2.com

Join them; it only takes a minute: Here's how it works: Anybody can ask a question Anybody can answer The best answers are voted up and rise to the top. Purchasing options between the bid and ask prices, or even at the bid price or below? My specific questions are: Ray K 7 I don't know enough about this because I don't actively trade options on the market. I think the essence of your question is whether placing a higher bid or lower ask than the prevailing market has a tendency to drive orders that might not otherwise occur, thus getting you better execution.

I don't know the answer, but it is certainly an interesting question. I think as your saying, I'm trying to understand relatively "illiquid" markets or small markets; also, interestingly how black-sholes fits in, since in options, different than stocks, there is so much simple formulae available to establish a price.

As such, how does that affect pricing This process is no different for options than for stocks. Also many brokers have difficulty updating options quotes.

AndrewS 2 9. Sign up or log in StackExchange. Sign up using Facebook.

Bidding overview

Sign up using Email and Password. Post as a guest Name. In it, you'll get: The week's top questions and answers Important community announcements Questions that need answers. MathOverflow Mathematics Cross Validated stats Theoretical Computer Science Physics Chemistry Biology Computer Science Philosophy more 3. Meta Stack Exchange Stack Apps Area 51 Stack Overflow Talent.