Company purchase of own shares accounting treatment

It is not uncommon to hear of companies purchasing their own shares from shareholders, explains Steve Collings. Typical scenarios include shareholders who wish to sell their shares in a company where other shareholders may not wish to buy them or where the shareholders are unable to raise the cash to purchase them.

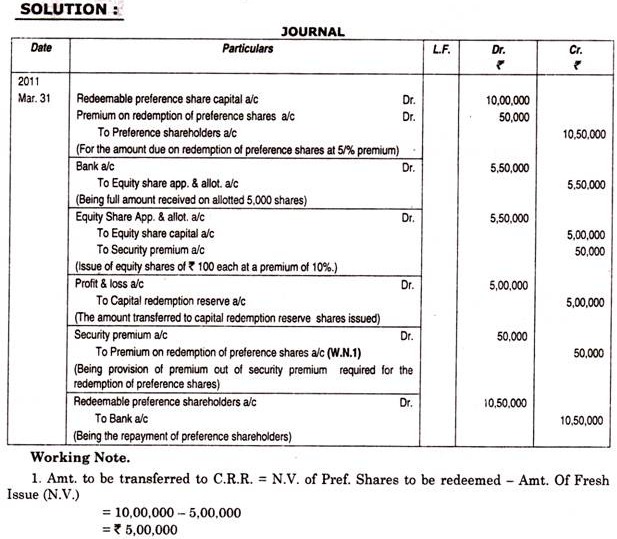

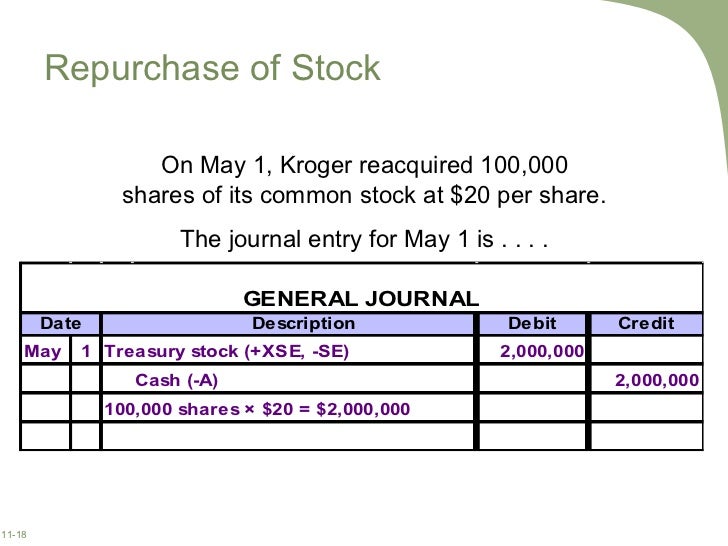

The accounting for such buy-backs can be tricky and there is a whole host of legalities to consider - some of which are obvious whereas others not so. This article will take a look at how the mechanics of accounting for such buybacks works and the legal considerations that should be made.

How to Account for Share Buy Back: 7 Steps (with Pictures)

The full article is available to registered AccountingWEB. Registration is FREE and allows you to view all content, ask questions, comment and much more.

Steve Collings, FMAAT FCCA is the audit and technical partner at Leavitt Walmsley Associates Ltd where Steve trained and qualified. About a year ago I wrote an article titled Share Buybacks - Get the Details Right.

Funding a share buy back Tax position Conditions for CGT treatment After purchase Company Law Conditions Final Points. If you click on the "share buyback" link at the bottom of the article, it will take you to our share buyback tag page , which collects previous articles and Any Answers threads on the subject - including the Get the details right article that Jennifer highlighted above.

Taken as a group, they should cover the main points you might need to consider in these situations. And if they don't try posting a question in Any Answers, and including "share buyback" in the Tags field when you post it.

I have a client who has an outstanding bill to their accountant and the accountant has said he would like shares in setttlement of his bill? I have read the very useful article by Steve Collings. However, I am filling in my company's Tax and Accounts Return Service form and I cannot see anywhere to make an entry for a capital redemption reserve.

This was approved by special resolution. Does anyone know how I should present this transaction in the accounts?

Does the advice given by Steve Collings only apply to larger companies?

Hi, Did you get an answer to your message? I am in the same situation and not sure how to get round this. Does anyone know what the implications are for the company when the buy back their shares for a nil consideration? Resources Podcasts About AccountingWEB Advertise on AccountingWEB Terms of use Privacy policy Contact us Got a question? What you need to know. Audit and Technical Partner.

Accounting for share buybacks : Steve Collings

Leavitt Walmsley Associates Ltd. Please Login or Register to read the full article The full article is available to registered AccountingWEB. Capital reduction or purchase of own shares? Assuming circumstances permit either. Try bookmarking this page too If you click on the "share buyback" link at the bottom of the article, it will take you to our share buyback tag page , which collects previous articles and Any Answers threads on the subject - including the Get the details right article that Jennifer highlighted above.

Thanks for your interest in this article, and the feedback.

Where is this "Share buyback" link at the bottom of the article? Accounting for share buybacks I have read the very useful article by Steve Collings. Capital Redemption Hi, Did you get an answer to your message? Share buy back nil consideration Does anyone know what the implications are for the company when the buy back their shares for a nil consideration? Please login or register to join the discussion. Most read this week 15th Jun Reasonable excuse round-up How innovation fuels Tayabali Tomlin.

We are life changers. Crunch gears up for growth.