Earnest money law in texas

Ask a Lawyer and Get Answers to Your Legal Questions. Thanks for your question.

Earnest Money | Legal FAQs for REALTORS® | For Texas REALTORS® | Texas Association of REALTORS

Here is reference to earnest money law in Texas. If you have follow up just ask here. Earnest money can be a major source of disagreement between buyers and seller. Perhaps a quick review of some of the pertinent issues will be helpful to you.

Earnest money is traditionally required by the terms of most real estate contracts to show that a buyer is seriously interested in purchasing the subject property and to provide a fund for recompense to the seller or other parties involved in the sale if the buyer fails to complete the purchase. Although real estate contracts traditionally do require earnest money, a contract to purchase and sell real estate does not have to require earnest money to be valid.

Furthermore, under the terms of the TREC contracts and most other real estate contracts, failure to deposit earnest money does not automatically terminate a contract.

A buyer who fails to deposit earnest money under the TREC contracts is in default under the contract and the seller can enforce the remedies provided by the contract, one of which is termination of the contract.

If a buyer fails to deposit earnest money, and a seller desires to terminate the contract, the seller should notify the buyer in writing that the contract is terminated due to the default of the buyer. Do not simply assume that your seller is not under contract because the earnest money deposit was not made and proceed with marketing the property to other potential purchasers.

Until the seller terminates the contract, there is a risk that the buyer will cure the default by depositing earnest money. If a seller has entered into a subsequent contract to sell without terminating the first contract, if the buyer cures the default by depositing earnest money, the seller may find that he has has two legally enforceable contracts to sell the same property.

When earnest money has been deposited and sales are not completed, whatever the reason, buyers and sellers often have disagreements about the disposition of the earnest money. The TREC contracts have fairly extensive provisions regarding earnest money. Under the TREC contracts, if both parties make written demand to the escrow agent for the earnest money, the escrow agent may require a written release from both buyer and seller before releasing the funds.

However, it is actually rather unusual for both parties to make written demand for the earnest money, although that certain happens. A much more common problem occurs when one party requests release of the earnest money and the other simply refuses to sign a release of the funds.

Two or three revisions back, the TREC forms were amended to attempt to address this problem by providing that if one party makes a written demand for release of the earnest money, the escrow agent is required to notify the other party of the request by providing a copy of the request. If the second party does not object in writing within 30 days to the release of the earnest money, the escrow agent is authorized to release the funds to the party requesting the release.

So, when you have a TREC contract the release procedure is very straight forward: In the real world, the procedure is often muddled by the parties and everyone gets offended and upset.

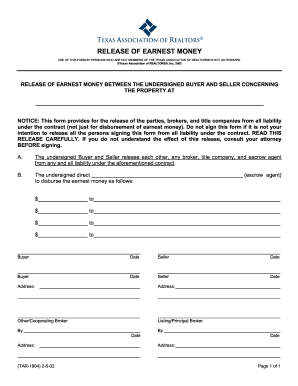

The common practice when a deal does not close is for the party who wants earnest money released to them to sign a mutual earnest money release form and send it to the escrow agent. Most of the release forms require the consent of both parties in order to release earnest money. If you sign and send a release of earnest money form to the escrow agent, the escrow agent typically forwards that release to the other party for signature.

Even if the second party fails to sign the release form, the party who signed the release form often feels entitled to the release of the earnest money then demands that the earnest money be released to them.

The problem is that most of the mutual release forms do not make demand by the party signing it for the release of earnest money as required by the terms of the TREC contracts. The form is designed to be used when both parties consent to the release of earnest money and if all you sent to the escrow agent was a mutual release form, you have not complied with the earnest money release procedure specified in the TREC contract which requires that you demand release of the earnest money.

The proper procedure under the TREC contracts to obtain the release of earnest money is to send written demand to the escrow agent for release of the earnest money. The escrow agent is required to forward the demand to the other party and if they do not respond within 30 days the escrow agent is authorized to release the earnest money to the party demanding it.

You may also send a signed mutual release form to the escrow agent which can also be forwarded to the other party by the escrow agent for signature. If the other party signs the release form, release of the earnest money can be accomplished by the mutual release.

However, even if the other party does not sign the mutual release form, the demand for release of earnest money entitles the demanding party to release of the earnest money after 30 days unless the other party objects to the release. Ask an Expert Ask a Lawyer. Experts are full of valuable knowledge and are ready to help with any question. Credentials confirmed by a Fortune verification firm. Via email, text message, or notification as you wait on our site.

Ask follow up questions if you need to. Rate the answer you receive. Ask Ray Your Own Question. Type Your Legal Question Here Ray is online now.

Does a buyer have to submit his earnest money with the offer? | Advice for Texas REALTORS® | Texas Association of REALTORS

What is the Texas Earnest money law. Customer Question What is the Texas Earnest money law. Ask Your Own Legal Question. JustAnswer UK JustAnswer Germany JustAnswer Spanish JustAnswer Japan.