How to use bollinger bands indicator

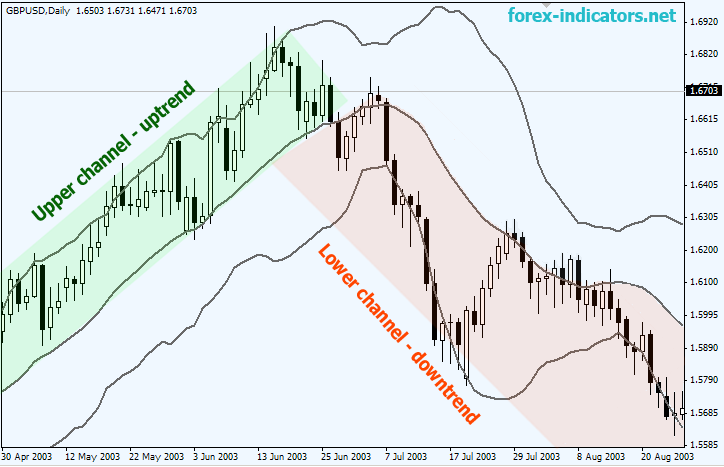

Bollinger Bands is a unique indicator with some awesome features that cannot be found in the other indicators. Bollinger Bands has three lines: Bollinger Upper Band, Bollinger Lower Band and Bollinger Middle Band. Bollinger Middle Band is nothing but a simple moving average , but it is the base of the other two upper and lower bands.

Bollinger Upper and Lower Bands measure the deviation.

Therefore, Bollinger Bands as an indicator is a great tool to show the markets overbought or oversold condition. It is overbought when the price has moved up and formed the maximum deviation from the middle band, and it is oversold when the price has moved down and has the maximum deviation from the middle band to the bottom of the chart. Under such a condition, overbought or oversold, there is the highest chance of forming the reversal signals.

Weak reversal signals usually take the price to the middle band again, and then the price follows the same course again.

Therefore, strong continuation signals form close to the middle band when the market is trending. When the market is moving sideways, it usually goes up and down around the middle band and the upper and lower bands get close to each other to show the high and low of the price range. As you see, Bollinger Bands can give you a lot of invaluable information about the markets condition. As I mentioned earlier, the middle band is nothing but a simple moving average which is set to 20 with Bollinger Bands default settings:.

Combining the candlesticks patterns with Bollinger Bands, creates a great trading system that shows the strongest continuation and reversal trade setups: Learn to Gauge the Trade Setups. In all the below examples, the Bollinger Bands settings is the default settings which is 20 period and 2 deviations.

How to Use Bollinger Bands - Fidelity

The sift is set to zero. As this indicators gives you a lot of information about the price movements and the markets conditions, there are several different ways that you can use it in your trading. One of the most important features of Bollinger Bands is that when the market is slow and there is no reasonable volatility , the upper and lower bands become close to each other:.

As you see on the above chart, Bollinger upper and lower bands have become so close to each other where the white arrows show. Just follow the numbers at the above image and you will see what I mean. The candlestick 1 has a long lower shadow. What does that mean? It means a big Bullish pressure is imposed to the market suddenly several buyers have started buying. So the price wants to go up.

This is the first signal. You could take a long position after this candle, but if you did not, the market would show you some more signals to go long. After candlestick 1, market becomes slow and Bollinger upper and lower bands become so close to each other. Candlestick 2 shows a breakout with the Bollinger lower band, but it is closes above. This candlestick also has a long lower shadow that reflects the upward pressure. Then the market becomes slow for several candlesticks, BUT candlestick 3 assures you that the range is broken.

Then some red candlesticks form, but you should know that after a range breakout, the very first reversal signal is not indeed a reversal signal. It is a continuation signal.

How to Use Bollinger Bands - Fidelity

I just brought it here as an example of a tight ranging market and its breakout. Line chart is plotted based on the close signal. Close price is very important specially when you want to interpret the Bollinger Bands signals and predict the market.

As you see the support and resistance of the range are shown much better in the line chart blue circles. Numbers 1, 2 and 3 are where the candlesticks 1, 2 and 3 formed on the previous chart. In the above line chart, the range breakout is confirmed while candlestick 3 was forming because the price line goes up, touches and rides the Bollinger Upper Band. This means the price has broken above the range, and now we have an uptrend. So we learned that the close price is very important when we work with Bollinger Bands.

Like the Fibonacci system , one of the ways of trading using the Bollinger Bands, is finding a range and then waiting for its breakout. Bollinger Bands are really good in following the trends. Please follow the numbers on the below chart. If I wanted to take a long position I would wait for more confirmation which is the 2 candlestick.

I would go long at the close of 2 candlestick. It is another confirmation for the beginning of an uptrend. Zone 3 is the most important part of the below chart.

Conservative traders prefer to take their long positions after the formation of such a confirmation. They go long when the price breaks above the thin red line 4. They place the stop loss below the low of the last candlestick that its shadow is broken down the Bollinger Middle Band. As you see it goes up strongly first red big arrow. There are some small red candlesticks but they should not be considered as reversal signals.

At 5, the price goes down to retest the Bollinger Middle Band. This is the beginning of the second Elliott Wave. It is where some traders wait for the retrace continuation to go long.

When you see the price has been going up strongly for such a long time, you should ignore the first and even the second reversal signal. They are not reversals. They are continuation signals in fact. I mean you have to consider them as continuation signals not reversals. So the price goes down, retests the Bollinger Middle Band, and it even succeeds to break below the middle band, but keeps on going up again. Fibonacci can be a big help here.

As you see at 7 and when it wants to break above the We should now expect it to break above the As you see it could even reach the It is the same as when we have a downtrend. Candlesticks touch and ride the Bollinger Lower Band. Bollinger Bands are great in showing the reversal signals too. Usually a nice reversal signal becomes formed when a candlestick breaks out of the Bollinger Upper or Lower Bands, and then it is followed by another candle which has a different color the confirmation candlestick.

One of the best examples can be seen in the above image at 1. Below, I am showing you the signal once again:. As you see the candlestick 1 which is a bearish candlestick is formed completely out of Bollinger Lower Band, and the next candlestick 2 which is a bullish candlestick has covered the body and upper shadow and also most of the lower shadow of candlestick 1. These two candlesticks form a signal which is called Bullish Engulfing.

It is a strong short reversal signal when it breaks out of Bollinger Upper Band. I strongly recommend you to learn the candlestick signals. A long upper shadow that has broken out of the Bollinger Upper Band strongly:. Note how both candlesticks broken out of the Bollinger Lower Band and how the second candlestick has covered the first one totally. Note how both candlesticks have broken above of the Bollinger Upper Band and how the second candlestick has covered the first one.

Also look at the big upper shadow that the second candlestick has formed. False signals always form. Indeed, the form a lot more than the true signal. True signals are easier to catch, because they are stronger and look outstanding. A good trader is someone who can distinguish and avoid the false signals: Strong Trade Setups Gauge. There are false range breakouts and also false reversal signals.

Those who like to trade the reversal signals, will be encountered with more false signals because a trend can be continued for a long time, and it is not easy to say when it will reverse.

If you like to avoid being trapped by false reversal signals just ignore the very first two reversal signals when there is a strong trend ongoing. For example, some traders take a short position when they see the below signal, but as you see this is not a strong signal compared to the signals I showed you above:.

The uptrend is really strong, and this signal is the very first reversal signal on such a strong uptrend.

What do I mean by strong uptrend? Look at the uptrend slope. It is a sharp slope that is going up strongly. There is no sign of exhaustion in it yet.

Look at the Bollinger Middle Band Slope the first red arrow. So the trend is still strong and has not formed any sign of exhaustion when this relatively true signal was formed.

You could take a short position, but you really had to get out when the continuation signal formed around Bollinger Middle Band. Now look at the below chart and follow the numbers. Find out why some signals are false, some are true and some are continuation. As you see Bollinger Middle Band works very well with the continuation signals when there is an ongoing strong trend. In an uptrend, continuation signals are formed when the candlesticks go down, retest Bollinger Middle Band, and then go up again.

Taking the continuation signals are much safer than the reversals, unless you make sure that the trend is really close to reverse and is already exhausted. This was just an introduction how to use Bollinger Bands in taking the reversal and continuation trade setups on the trending and sideways markets.

You need to practice more to become expert in locating the true signals. Learn more about Bollinger Bands:.

I have studied this most effective indicator explanation and got photo copy for ready reference. Indicator has been explained in very clear manner. I will use this strategy in my trade. Thanks a much for such demonstration. Great man…I have never seen such a great explanation even upon paying tuition fees.

U r really Excellent. I am looking forward article from you regarding candlestick reversal signals and false signals…. I am learning from your article and that would be really helpful for all of us basically for me. So, thanks again and please try to help us to get more skilled with the other ways to do better in Forex trading.

From the start i was stick with the BB indicator but not use it with details. This could help me better in BB. The break away gap in the last graph at 7 which was tagged relatively true reversal signal is also a confirmation of change in polarity.

This occurred just after the bearish engulfing pattern at 7. My question is does break away gap join in fundamental analysis of a trend in such suitation? Thank you so much. The fact that you explain everything so clearly is amazing. The fact that you also involve real life examples of stocks and having us do questions helped the info sink in even more!

The above article is clear to understand. Mainly, because they are in the Middle Band region and since it is in Middle Band, it could be retesting the Middle Band or breaking away from the Middle Band, how can a novice trader consider continuation and confirmation as a trade setup? I know we can consider the close price to determine the direction.

But, going back on some charts and seeing such signals — it proves to be quite a tricky setup with chance. We have talked about the candlesticks that need confirmation in different articles:. Also this article talks about the continuation trade setups in more details: Hey Chris my confidence in trading confidently increases by every article of yours I read even without paying a dime More grease to your elbow and more assets in your arsenal,you did quite well and God will bless all your pips Thanks.

I am new forex trader and start trading right now. Explain in a very simple and more efective ways. Chris Pottorff for a such a nice article which specially very helpful for New trader…. Open, Close, High, Low and TrueRange.

Which one should I choose to have exactly the Bollinger Bands you are using to trade? What time frame is suitable? Here is the answer about time frame: Are you new to forex Rezze? Then please read this article first: You know I have got it, when I ask less questions.

But at the moment, like a sponge I am absorbing your materials. And they are all good and consistent. Referring to point 2 above on reversals. Does it matter to the strength of the setup if in the piercing line above, the upper shadow is also very long. What if both candles with beautiful size and long shadows were out of the BB range, and none made back or crossing into the BB range? What do you make out of the strength of such a setup?

Do you wait for another confirmation? Yes, it is a negative point for a long trade setup: What if the candlestick preceeding 1 was also outside the BB range? Say it went bearish body and shadows under the lower BB, and candlestick 1went up bullish strongly but still outside the lower BB? Would it have been a good setup? Is this a strong trade setup?

What would you score it? Yes, it a score trade setup that we took it and we use it to compare the other short trade setups with: I suggest you to read all the articles listed on the below post carefully and patiently.

What I understand from the number of questions you ask while you have not read the articles carefully, is that you are excited and in a hurry. This is not good for a forex trader: Thank you for your wisdom.

I really appreciate your helpful attitude and being extremely patient with me. You are right that I am excited and in a hurry to understand it. I too have lost a lot of money, and we are not talking about just tens of thousands. In fact, I had decided to not trade again but to just invest using value investing. But I still got burnt on good companies because of there are just too many variables, e. Hence, I find currencies are much purer. And the market size is so large that it is not easily manipulated.

Having said that, I have actually read so many of your articles. Including the one you mentioned above. But because I read so much, whilst I may remember the pattern, I may not remember the currency pair and the dates. Chris, your article https: I am actually talking about a bullish entry on Are you talking about the same thing? You did go long on This is question was to illustrate whether a breakout where the candles are still outside the range and not making it back into the BB range can still be considered as a strong trade?

Now, you are right about not too hurry it up, and read up the articles patiently. A very important advise. I promise to remind myself on that. I am trying to do backtesting now, and see what the outcome is. We also talked about that too strong weekend gap that GBP cross currency pairs opened with: It was a strong setup on the weekly, but on the daily it formed on a too bearish market when the So we avoided it on the daily.

Dear Chris When we look for nearest resistant or support lines some of them turns from downside to upside the other opposite. So if we think about going long or short which one we should consider?

Both or opposite turning point? I hope explanation of my question is clear enough. English not my first language Thank you Dogan. When there is a downtrend or range, a descending resistance is a better choice to go long. And visa versa for going short. Thank you for time to answer me. I hope this is not a silly question. When I want to go long as using line chart over the price level there are some turning points. I know old support and resistance turning to to each other. Do I need to consider all this turning points as resistance or just only clockwise?

Your candlestick explaination is simply superb, i have learned and practised in demo account and was successful. How can I change that and see exactely what I see in your charts? Hello Chris, thanks for sharing your knowledge and experience. Just a quick question about engulfing strategy, does it also work on weekly and monthly timeframes?

With my shortage of experience I think I will probably take 4 false signal because of many positive points. Too strong engulfing candle which is break BUB and engulf too many candles. Abandoned baby candle above BUB before engulfing candle 3. BMB breakout and closing price is below BMB. There are signs of exhaustion and bears pressure. Consolidation for almost three weeks after 3 false signal, which I will consider like hesitation. Based on that market condition I will probably take this trade signal with riskier SL which is good and after being stopped out, continuation candle while gave me new signal to enter on trade.

It is formed by a too long candlestick with a considerable lower shadow. Indeed, it is not a false signal. It is a bad signal.

Thank you so much Chris you are indeed a forex angel. I do have a question though. Please how can one use this strategies to trade shorter time frames like 5, 10, 15, 30 minutes also can this be applied to binary options? You can use the same way on any time frame or price chart. Just keep in mind that shorter time frames are riskier to trade. Do you mean that, if the closing price of a candle is above an upper band, there is no band breakout?

But the closing price of the third candle of the first example, it closed above the upper band, so how can it be a BB breakout? Or were you doing simple technical analysis? Thank you very much. Oh sorry, english is not my first language. But, about the middle band, you said we can use it to trade continuation signals, but you also said that is risky or riskier than your normal trading.

So, how can I trade continuation signals, if there are no strong reversal signals? Thanks a lot for your time and help. You trade the strong candlestick patterns that for as continuation setups. The power of the candlestick pattern which is agreeable to the trend is important. What about the double bollinger bands? Everything about that system is explained here: Yeah, I read it all, and I think is the easier continuation signal?

What do you think? Is the BB1 breakout, even realible for your sistem? My question is if a candle shadow break above the upper Bollinger, bullish or bearish candlestick, with out creating any pattern, how it can be explained. It is just a strong price movement and deviation from the middle band.

It means the related party is controlling the market strongly.

How to Trade Stocks Using Bollinger Bands ( Simple Method) (Hindi) 2017When the shadow is too long, it means the opposite party is trying to take the control, but have not been successful yet. Thanks Chris you always put the psychology of trading and traders in your articles which make them unique.

For the first time in my life I can get a little feeling that I really understand how market works. I just need to read your articles more carefully and do some highlights.

Your explanation of Bollinger bands in this article was awesome. It means a big Bullish pressure is imposed to the market suddenly. What is happening Chris when the shadow occur above the candle?

And the explanation is the same if the candle is Bearish? Basically do we have to follow the candles when breaking out the bollinger bands or the shadows are most important.

Hi Chris Once again i am surprised by your perfectly written Article. So many important sentences in this Article. Again your way of explaining the psychology of the market is so catching for me.

Top 6 Bollinger Bands Trading Strategies

Please start from here: The stock ex tcs has reached the upper band ,still it is bullish one or some reason like some profit booking in tcs can reduce the stock little lower or the index like Nifty is consolidating so tcs can lower so that days the False signal is formed. If Nift is up or tcs has some gud news it will bounce back. If you short that time that will hit your stoploss. Then only we can short. Hello Dear Chris I am Learning too much From Your articles but i am new Forex learner so i am in little confusion after reading the analysis of strong piercing line pattern article that you said in above paragraph 2.

Reversal trends 1st Paragraph how candle stick 1 and 2 make piercing line Pattern I mean in that pattern 1st candle is bearish and 2nd is bullish and close little below the 1st candle other wise it would be Bullish Engulfing….. Can you suggest me how the Bolinger band average period and candle stick time 5 min,10 min,30 min ,1 hour chart for intraday trading.

Now I use the Bolinger period average period as 12 days and 5 minutes candle chart for intraday trading in index. But some says the upper band is overbought area and lower band is oversold area. I though have one question; Is this Training based on long term period traders, 1 hour, 4 hour,1 day?

It is hard to check one chart by one chart especially during working hours. Appreciate if you could consider, thanks, Chin. About the bollinger bands, I have one question. For example, we know that if the bands are too close, it means that the interest on buying and selling is low. But, what does it mean, when one band is downward, while the other is upward? Market indecision and high volatily?

If a chart is volatile and is trending down strongly, but the lower band points up, it is because, after an high volatily, the market is oversold, and will likely bounce up from close support level? How do the bands relieve it? This occurs usually when the price starts taking a direction suddenly after a while of moving sideways.

After few candlesticks, both bands will follow the price direction. It was among one of the old articles of this site. I am now reviewing and editing them. I have added some more tips and delete the obsolete parts.

I hope you are fine.

Doji article is closed for comment,so I will ask you here. What do you think about last closed candlestick on EURUSD Daily chart? As usual, thank you for an excellent article. You also said that 8 was confirmation for the 7 formation. What about the two candlesticks immediately following 7? One is a very small bodied bull candlestick followed by a large strong bodied bear candlestick that even breaks the Bollinger middle band.

Why would you need 8 for confirmation when you have such a strong bearish engulfment pattern immediately following 7?

Are there any negative points that would negate that bearish engulfment pattern? Those small candlesticks are just 2 hours old candlesticks that were used to form on the platforms on Sunday afternoon on the daily chart.

It was because of the broker sever time difference and forex market open on Sunday afternoon. They are not valid daily candlesticks. But sometimes is difficult to determine trend,because after strong trend the market is behaving strangely. In chart below we had strong downtrend in previous structure.

The angle is very steep, and after then we should wait for trend continuation setup,right. But after that the price is start to go up and down, up and down,and we did not have a clear trend. You had to wait for a trend continuation setup after the price went up. But such a setup never formed. As a result, you stay out. Leave a Reply Cancel reply:. Your email address will not be published. Notify me of followup comments via e-mail.

You can also subscribe without commenting. Get Our New E-Books For Free. Bollinger Bands in Forex and Stock Trading [With Detailed Pictures] By: Bollinger Bands Last Updated: Enter Your Email Address and Check Your Inbox: LEARN A PROVEN BUSINESS PLAN.

November 17, at December 1, at 2: December 28, at 3: March 13, at 1: March 12, at March 20, at April 7, at June 26, at 4: July 2, at 6: July 2, at 1: July 5, at July 16, at 2: August 15, at 2: August 15, at 3: August 15, at 9: August 26, at September 6, at September 13, at 2: September 14, at 4: September 14, at September 15, at 5: October 15, at 1: October 15, at 2: October 16, at 7: November 26, at 8: November 27, at 2: November 28, at 2: November 28, at November 29, at 6: November 29, at 3: November 29, at 7: November 30, at January 22, at 7: January 23, at 2: January 23, at 9: February 9, at 4: February 16, at 3: February 17, at 8: February 17, at 1: March 1, at 4: March 1, at 5: March 17, at 5: March 18, at 8: March 18, at April 15, at 8: April 15, at 2: April 15, at 3: April 16, at 3: May 3, at May 4, at 2: May 4, at 3: May 4, at 4: May 5, at 4: May 5, at 5: May 6, at 5: May 31, at June 1, at 2: August 2, at August 3, at 1: August 3, at August 10, at August 27, at 3: September 10, at 3: August 29, at 7: September 10, at 4: August 29, at 3: November 7, at 6: November 23, at 8: December 5, at 5: November 25, at 5: December 17, at 4: January 23, at March 20, at 2: May 18, at 7: May 18, at 8: July 12, at 7: September 18, at 4: September 18, at 6: February 15, at 9: February 15, at February 16, at February 16, at 5: February 16, at 2: February 16, at 4: February 22, at 3: February 17, at 2: February 19, at February 22, at 4: Leave a Reply Cancel reply: The Easiest Way to Get Rich Fast.

Learn How to Get a Job with Mississippi Department of Employment Security Candlesticks or Support and Resistance Levels? Success Business Blogging Trading Investment. Home LuckScout Mementos Contact About Archive Privacy Policy Terms. This Is More Important Than the Article You Are Reading:. Are You Enjoying Our Site? Our eBook Is Even More Important!