2oo8 stock market crash

This period also ranks among the most horrific in U. Those who lived through these events will likely never forget the turmoil. So what happened, exactly, and why? Read on to learn how the explosive growth of the subprime mortgage market, which began in , played a significant role in setting the stage for the turmoil that would unfold just nine years later.

Subprime mortgages are mortgages targeted at borrowers with less-than-perfect credit and less-than-adequate savings. An increase in subprime borrowing began in as the Federal National Mortgage Association widely referred to as Fannie Mae began a concerted effort to make home loans more accessible to those with lower credit and savings than lenders typically required.

The idea was to help everyone attain the American dream of home ownership. Since these borrowers were considered high-risk, their mortgages had unconventional terms that reflected that risk, such as higher interest rates and variable payments.

Learn more in Subprime Lending: Helping Hand Or Underhanded? While many saw great prosperity as the subprime market began to explode, others began to see red flags and potential danger for the economy. Bob Prechter, the founder of Elliott Wave International, consistently argued that the out-of-control mortgage market was a threat to the U.

In his book "Conquer the Crash," Prechter stated, "confidence is the only thing holding up this giant house of cards. Thus, ever-increasing mortgage default rates led to a crippling decrease in revenue for these two companies. Learn more in Fannie Mae, Freddie Mac And The Credit Crisis Of Among the most potentially lethal of the mortgages offered to subprime borrowers were the interest-only ARM and the payment option ARM , both adjustable-rate mortgages ARMs.

Both of these mortgage types have the borrower making much lower initial payments than would be due under a fixed-rate mortgage. After a period of time, often only two or three years, these ARMs reset. The payments then fluctuate as frequently as monthly, often becoming much larger than the initial payments.

For more on this type of mortgage, see This ARM Has Teeth. In the up-trending market that existed from through , these mortgages were virtually risk-free. A borrower, having positive equity despite the low mortgage payments since his home had increased in value since the purchase date, could just sell the home for a profit in the event he could not afford the future higher payments.

However, many argued that these creative mortgages were a disaster waiting to happen in the event of a housing market downturn, which would put owners in a negative equity situation and make it impossible to sell. Dvorkin, president and founder of Consolidated Credit Counseling Services Inc. You cannot be the wealthiest country in the world and have all your countrymen be up to their neck in debt. During the run-up in housing prices, the mortgage-backed securities MBS market became popular with commercial investors.

An MBS is a pool of mortgages grouped into a single security. Investors benefit from the premiums and interest payments on the individual mortgages it contains. This market is highly profitable as long home prices continue to rise and homeowners continue to make their mortgage payments. The risks, however, became all too real as housing prices began to plummet and homeowners began to default on their mortgages in droves.

Learn how four major players slice and dice your mortgage in the secondary market in Behind The Scenes Of Your Mortgage. Another popular investment vehicle during this time was the credit derivative , known as a credit default swap CDSs. CDSs were designed to be a method of hedging against a company's creditworthiness, similar to insurance. But unlike the insurance market, the CDS market was unregulated, meaning there was no requirement that the issuers of CDS contracts maintain enough money in reserve to pay out under a worst-case scenario such as an economic downturn.

The crisis: A timeline - The events that broke Wall Street (1) - gedyfej.web.fc2.com

This was exactly what happened with American International Group AIG in early as it announced huge losses in its portfolio of underwritten CDS contracts that it could not afford to pay up on. Learn more about this investment vehicle in Credit Default Swaps: An Introduction and Falling Giant: A Case Study Of AIG. By March , with the failure of Bear Stearns due to huge losses resulting from its involvement in having underwritten many of the investment vehicles directly linked to the subprime mortgage market, it became evident that the entire subprime lending market was in trouble.

Homeowners were defaulting at high rates as all of the creative variations of subprime mortgages were resetting to higher payments while home prices declined. Homeowners were upside down - they owed more on their mortgages than their homes were worth - and could no longer just flip their way out of their homes if they couldn't make the new, higher payments.

Instead, they lost their homes to foreclosure and often filed for bankruptcy in the process.

Stock market crash - Wikipedia

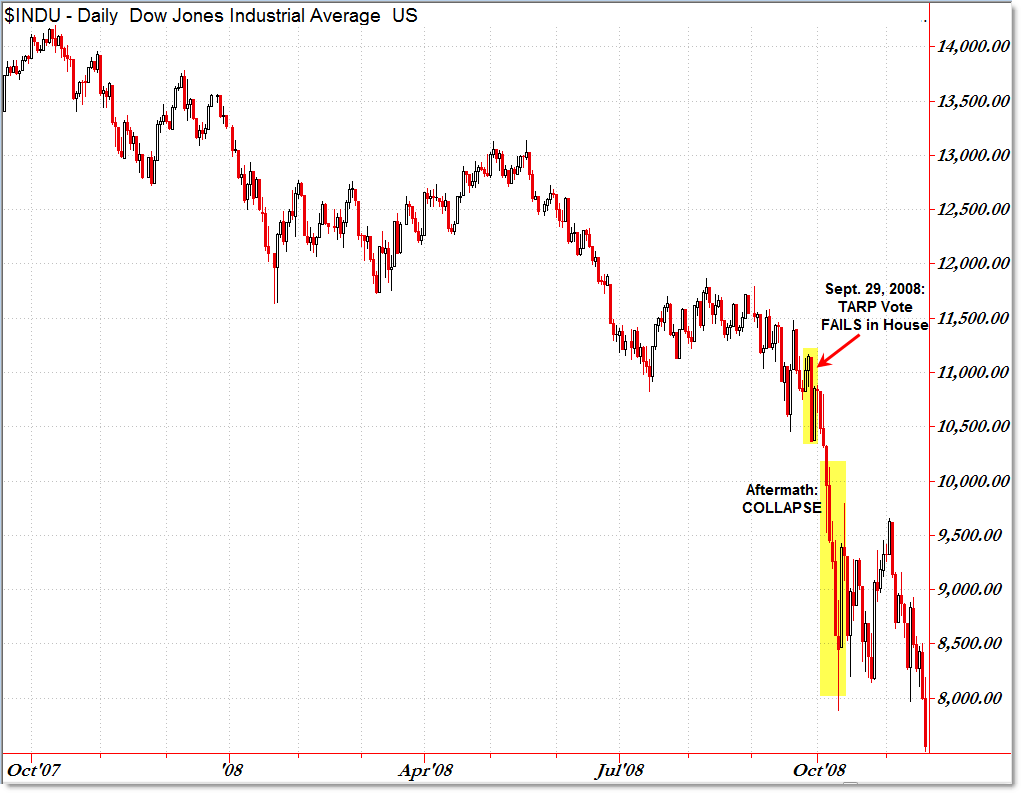

Take a look at the factors that caused this market to flare up and burn out in The Fuel That Fed The Subprime Meltdown. Despite this apparent mess, the financial markets continued higher into October of , with the Dow Jones Industrial Average DJIA reaching a closing high of 14, on October 9, The turmoil eventually caught up, and by December the United States had fallen into a recession.

By early July , the Dow Jones Industrial Average would trade below 11, for the first time in over two years. That would not be the end of the decline. One week later, on September 14, major investment firm Lehman Brothers succumbed to its own overexposure to the subprime mortgage market and announced the largest bankruptcy filing in U. The next day, markets plummeted, and the Dow closed down points at 10, This loss was due to the holding of commercial paper issued by Lehman and was only the second time in history that a money market fund's share value has " broken the buck.

For related reading, see Will Your Money Market Fund Break The Buck? The Collapse of Lehman Brothers. On the same day, Bank of America NYSE: BAC announced that it was buying Merrill Lynch, the nation's largest brokerage company. AIG , one of the nation's leading financial companies, had its credit downgraded as a result of having underwritten more credit derivative contracts than it could afford to pay off.

On September 18, , talk of a government bailout began, sending the Dow up points.

Also on this day, the Securities and Exchange Commission SEC initiated a temporary ban on short-selling the stocks of financial companies, believing this would stabilize the markets. The markets surged on the news and investors sent the Dow up points to an intraday high of 11,, finally closing up at 11, These highs would prove to be of historical importance as the financial markets were about to undergo three weeks of complete turmoil.

For more insight, see Liquidity And Toxicity: Will TARP Fix The Financial System? The Dow would plummet 3, points from the September 19, , intraday high of 11, to the October 10, , intraday low of 7, The following is a recap of the major U. The events of the fall of are a lesson in what eventually happens when rational thinking gives way to irrationality. While good intentions were likely the catalyst leading to the decision to expand the subprime mortgage market back in , somewhere along the way the United States lost its senses.

The higher home prices went, the more creative lenders got in an effort to keeping them going even higher, with a seemingly complete disregard for the potential consequences. When one considers the irrational growth of the subprime mortgage market along with the investment vehicles creatively derived from it, combined with the explosion of consumer debt, maybe the financial turmoil of was not as unforeseeable as many would like to believe.

Find out how this tough economic period can be a learning experience for all in The Bright Side Of The Credit Crisis. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Stock-market crash of The countdown begins - MarketWatch

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. The Fall of the Market in the Fall of By Paul Kosakowski Updated May 8, — 2: Unprecedented Growth and Consumer Debt Subprime mortgages are mortgages targeted at borrowers with less-than-perfect credit and less-than-adequate savings. Market Decline By March , with the failure of Bear Stearns due to huge losses resulting from its involvement in having underwritten many of the investment vehicles directly linked to the subprime mortgage market, it became evident that the entire subprime lending market was in trouble.

Complete Financial Turmoil The Dow would plummet 3, points from the September 19, , intraday high of 11, to the October 10, , intraday low of 7, GS and Morgan Stanley NYSE: MS , the last two of the major investment banks still standing, convert from investment banks to bank holding companies to gain more flexibility for obtaining bailout funding. After a day bank run , the Federal Deposit Insurance Corporation FDIC seizes Washington Mutual, then the nation's largest savings and loan, which had been heavily exposed to subprime mortgage debt.

Its assets are transferred to JPMorgan Chase NYSE: The TARP bailout plan stalls in Congress. The Dow declines points 6. C acquires Wachovia, then the fourth-largest U. Learn how the biggest ones affected the economy in Top 6 U. The Dow closes below 10, for the first time since President Bush announces that he will host an international conference of financial leaders on November 15, The Bottom Line The events of the fall of are a lesson in what eventually happens when rational thinking gives way to irrationality.

Subprime mortgages are offered to borrowers with low credit ratings, usually or below.

The Fall Of The Market In The Fall Of

As home-buying technology has progressed, the process of finding the best mortgages rates can all be done online. From lenders to buyers to hedge funds, it appears everyone has blood on their hands. Take a look at the factors that caused this market to flare up and burn out. Is this a cure or a curse?

You may be anxious to buy a home, but taking time to save a large down payment has numerous advantages. Four major players slice and dice your mortgage in the secondary market. The subprime collapse could mean doom and gloom for housing, equities and the overall economy. Discover the risks associated with subprime mortgages. Find out whether taking out a subprime mortgage on your home is really Clarify your understanding of subprime mortgages.

Learn about the different types, how they work and when they might be beneficial. Buying homes became increasingly difficult after the housing bubble burst. Since then, subprime mortgages have been making Collapsing home prices from subprime mortgage defaults and risky investments on mortgage-backed securities burst the housing An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable.

In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers.

Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.